Here’s the quote, for those unfamiliar: “Throughout history, poverty is the normal condition of man. Advances which permit this norm to be exceeded — here and there, now and then — are the work of an extremely small minority, frequently despised, often condemned, and almost always opposed by all right-thinking people. Whenever this tiny minority is kept from creating, or (as sometimes happens) is driven out of a society, the people then slip back into abject poverty. This is known as “bad luck.”

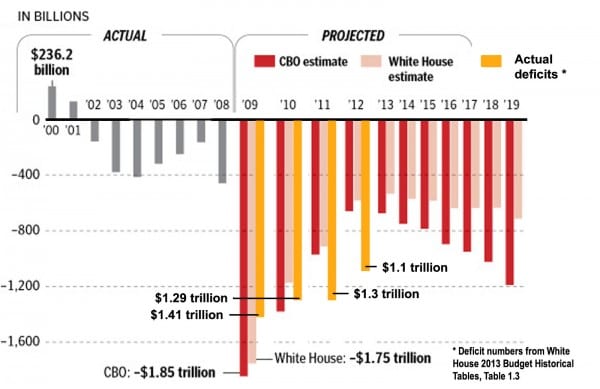

Oh, and just to remind that not only do tax-rate cuts not cause financial crises and recessions, but the wars didn’t cause the deficit or debt increase.

It’s a shame that Kelly Ayotte didn’t have that chart handy yesterday when Governor O’Malley spewed his stupid ignorance. Or lie. Or whatever it was.

Which book is the “bad luck” quote from?

Time Enough For Love. I think it’s one of many from the journal of Lazarus Long.

This looks like a pretty complete representation.

Yes, those graphs look scary, but after hanging out at Cullen Roche’s place (pragcap.com) (a place I learned about hanging out here) one gets a different take.

The deficit is barking up the wrong tree, people. However bad things are now, in the absence of the deficit, things would be much, much worse. The large deficit is in fact the only thing Mr. Obama is doing right, and he is too obtuse or ignorant of even the economic facts on his own side to reason that way.

Maybe because he too is a “deficit hawk” and he has his monomaniacal pursuit of his Great White Whale in the form of “higher taxes on the rich.” Taxing the rich is not the solution to a policy problem or even a social problem. The tax rates on the rich are only the “pasteboard mask” behind which the real evil lies, and so on.

The real economic problems are two fold — high energy prices and the overhang of the pending expiration of the “Evil Bush Tax Cuts.”

The trigger, not the underlying cause, that was the loose mortage lending rultes, but the trigger was the spike in oil prices brought about in Summer 2008 by Putin’s little war in Georgia.

Since then, energy prices have been driven nearly back to those levels through Mr. Obama’s environmental policies, largely implemented through executive fiat, along with the the rolling renewals of the Bush tax cuts, without making them permanent, which makes every major business decision contingent on “the other shoe dropping.” Oh, and the Charlie Foxtrot that the implementation of the Affordable Health Care Act promises to be doesn’t help either.

Like CO2 and supposed Climate Change, the deficits have nothing to do with the prolonged slow growth out of a deep recession, they are more a symptom (warming temps puts more ocean CO2 in the air) rather than a cause (CO2 causes “greenhouse” warming.

What has Mr. Obama done wrong? 1) done everything in his power to make energy of all kinds more, not less expensive — energy is literally the engine driving the economy. 2) kept the Bush Tax Cuts on a kind of Perils-of-Pauline rolling crisis deadline basis instead of cutting a deal on a long-term tax framework, almost any kind of framework including his “tax cut for the middle class but stick-it-to-the-rich” might do as to give something for people to adapt to, and according to Bob Woodward, he had such a deal with John Boehner and walked away from it, but he cannot negotiate his way out of a wet paper bag to cut a deal with Congress. 3) the uncertainty regarding the looming implementation of Obamacare, especially in light of his record for seemingly capricious regulatory behavior on the executive side.

The deficit is the least of our problems right now.

I know what your position is Paul, but I’d like a little more clarification. Why exactly is runaway entitlement spending not also one of our “real economic problems”?

The entitlement spending, to some degree, is one of those New Deal “stabilizers” — when the economy goes down, more people apply for unemployment compensation, food stamps, more people take early retirement, more of the people who could work if there was a big demand for workers petition for disability, and so on. If we turn the economy around, we turn around entitlements because people will want to work to get their share of a growing economy. And the way to grow the economy is to focus like a laser beam on energy, and not just this wimpy “alternative energy” stuff.

Had Mr. Obama done the things I listed — made good on his campaign promises on allowing drilling, made good on his campaign promise to “transcend politics as usual” and yes, accept John Boehner’s deal, no matter how distasteful that deal was to many here, maybe did so more political transcending and made similar compromises on Obama Care rather than letting Speaker Pelosi ram it through post the Scott Brown referendum on that topic, had he done all the things, we wouldn’t be sitting here thinking that Mr. Romney becoming President is within reach.

The thing is for all of this post-partisan politics, the man cannot post-partisan to save himself, he doesn’t know that there is a whole other point of view out there.

As for the Libertarian/Right/Conservative blogosphere, it is so stuck in our craw that people are drawing government benefits in the depths of the most serious catastrophe since the 1930’s.

My plan for economic growth and political victory is to concentrate on three things: energy, energy, and energy.

“The deficit is the least of our problems right now.”

To the contrary, the deficit is by far our biggest problem — bigger than ObamaCare, the recession, and the energy crunch combined (though they are serious problems as well).

The problem with the current deficit is that, unlike the Bush deficits, the Obama deficits cannot be financed through borrowing. It is simply not possible to borrow that much money. (About $400 billion / year seems to be the max.)

The current deficit is being financed by “borrowing” it from the Fed, which is creating it out of thin air. This “quantitative easing” is causing the Fed to greatly expand the money supply with no underlying expansion of the economy. This devalues the U. S. dollar and any asset based on dollars (cash, checking accounts, savings accounts, money market accounts, certificates of deposit, any fixed-rate bonds, etc.) — a large portion of middle-class wealth, particularly that of older Americans.

This must manifest itself as inflation. You’re already seeing it in the skyrocketing price of food, fuel, and commodities. It will spread throughout the economy when businesses can no longer absorb production cost increases. (Ironically, the recession is helping to mask the underlying inflation.)

The only way to halt this inflation is to stop quantitative easing, and the only way to do that is to reduce the deficit below $400 billion / year or so.

The Republicans might not have the balls to do that (though there are signs that Romney gets it). The Democrats do have the balls to make matters worse.

Check out Cullen Roche at pragcap.com. He is not a raving Obamite Leftist.

The Deficit is not the problem — focusing on it will bring us to electoral defeat, and if we win and make the Deficit the focus, we will cause greater wreckage than Mr. Obama in his dreams.

There is nothing in either Romney or Ryan’s plan to do anything immediately on the deficit. They’re just trying to get it on a glide path, and unleash the economy.

There is nothing in either Romney or Ryan’s plan to do anything immediately on the deficit.

That’s not accurate. Romney promises to reduce spending to 20% of GDP by the end of his first term. He promises to keep defense at at least 4%, and to make no cuts to Medicare (he’d add back the $716B over 10 years) or Social Security. To reach the 20% goal he’d have to cut everything else by 40% (he wants to cut overall spending by 16%, but exempt 60% of the budget — defense, Medicare, SS — and 40% of the remaining 40% is 16%).

There’s no way he’d actually do that, or that Congress would go along — it would trigger a recession, and doom all their chances for reelection. But it’s “in his plan”.

Jim, you are overlooking growth (sort of like Obama has these last four years). A growing economy means less cuts and more tax revenue.

Even if Romney miraculously gave us 5% GDP growth he’d still have to make deep cuts, and of course those cuts would retard growth.

Cutting wasteful and unproductive expenditures does not retard growth.

It is simply not possible to borrow that much money.

Of course it is — there is a near-insatiable demand for US debt, which is why investors are currently willing to pay (!) for the privilege of holding it.

This must manifest itself as inflation

And yet it hasn’t. Wages are stagnant.

When quantitative easing started economic observers fell into two camps. Some, including Paul Ryan, Ron Paul, etc. predicted a spike in interest rates and inflation. Others, like Paul Krugman, predicted that inflation and interest rates would stay low. Reality — three years of low inflation and low interest rates — has utterly vindicated Krugman’s model.

The Fed is currently buying over 60% of the US government debt, so that suggests you are once again wrong. To buy the debt, they’re inflating the money supply. We’re seeing the effects in areas such as the international price of oil (set based on US dollars) and food, which conviently enough are not included in the official government inflation calculations. Ask people about the prices of things they buy and see if they believe inflation is low.

OK, Jim, so by the technical definition (because they took food and fuel among other things out of it), we have low inflation. And we have low interest rates, which fucks over people (like retired people) whose income comes from low-risk investments.

So the fact that the prices of things that most people have to buy are rising much faster than their wages or income is a reason to reelect the president?

Good luck with that pitch.

I’m not arguing that people don’t have an economic reason to vote against Obama — the economy isn’t good.

But the last few years were a great test of economic models, and the predictions of Keynesians have performed much better than those of Austrians. That fact should influence the policies we choose going forward (i.e., more quantitative easing and deficit spending, not austerity).

That’s nuts. What the Austrians would have proposed was not tried in any way, in any form.

Reality — three years of low inflation and low interest rates — has utterly vindicated Krugman’s model.

Did “Krugman’s model” say anything about GDP? If you’d plugged in the total spent on QE1-2-3, would the “model” have spit out 1.3%?

I’m guessing you’re in favor of QE3 being open-ended. Since demand for US debt is insatiable, we should be able to just keep doing it indefinitely.

the predictions of Keynesians have performed much better

Really? Can you show a chart of predictions vs performance to back up your claim?

“The Democrats do have the balls to make matters worse.”

“more quantitative easing and deficit spending, not austerity”

Did I call that one, or what?

I know, that’s like calling that gravity will make things fall down instead of up, but hey, it’s what I do.

What the Austrians would have proposed was not tried in any way, in any form.

The Austrians predicted that what was tried would certainly result in inflation and high interest rates. Their model failed.

The Austrians predicted that what was tried would certainly result in inflation and high interest rates.

They didn’t say when. It will happen if this continues.

The Keynesians said that if we passed the porkulus, that employment wouldn’t go above 8%. Why don’t you say their model failed?

Wages are stagnant

Which has what to do with the price of things?

Aside from other reasons that the demand is very limited, we’ve already started suffering downgrades in our credit rating. As happened with some of the European debt, once it crosses below certain rating threshholds most firms are forced to dump it like it was a toxic asset.

Guess what? Interest rates are low because the Fed is keeping them low. The only thing that effects interest rates is the whim of the Fed.

I ran across an interesting economics paper a few weeks ago (which I have yet to find again) which argued that the post-war US unemployment rate can be explained with only two variables, oil prices and interest rates, and that this also explains the recession in the middle of Bush’s term which was otherwise pretty mysterious.

Based on that paper, we should be in a continued recession with high unemployment, and will remain so until energy prices fall.

Amen, hallaluja, and a few more words to satisfy the spam filter.

You forgot the silent h which is important because it means praise Jah.

Perhaps, just perhaps, it’s not such a wild idea to suggest that high oil prices and borrowing to spend both contribute to this bad economy?

the wars didn’t cause the deficit or debt increase

Surely you jest. Do you honestly think spending $1 trillion per war is going to help the deficit? Sure Rand keep spending yourselves to bankruptcy. The cause of failure for every empire in human history is more or less the same. Horrendous military expenditures for fighting enemies which aren’t worth the effort compounded by trade deficits leading to a weakened economy and eventually the inability to defend the core of the empire itself. The trillion spent on a war could have gone to investments in infrastructure to help the economy instead. The Iraqi war was pointless and the war on Afghanistan could have been done for much cheaper than this. Now that Bin Laden is dead it is best to simply pack up and leave. The only way to defeat the Taliban is to end Pashtun nationalism and that is simply not going to happen.

tax-rate cuts not cause financial crises and recessions

The tax breaks did not help fuel an economic recovery at all. Neither did the W malinvestments in fuel cells, hydrogen storage, clean coal which had much worse outcomes than the ones in batteries and wind done in this administration. If the tax breaks for the rich are being used to prop up their savings accounts in the Cayman islands or their investments in China they are not helping the US economy. Unless you want to live with Chinese levels of income or pollution the money isn’t going to get back real soon either.

To me the main cause of the crisis was the Fed’s interest rate policy but this was not determined by any US government. The other main cause was war expenditures. The remaining cause is the lack of competitiveness of the US economy, and other Western economies in general, with the Asians after the globalization drive.